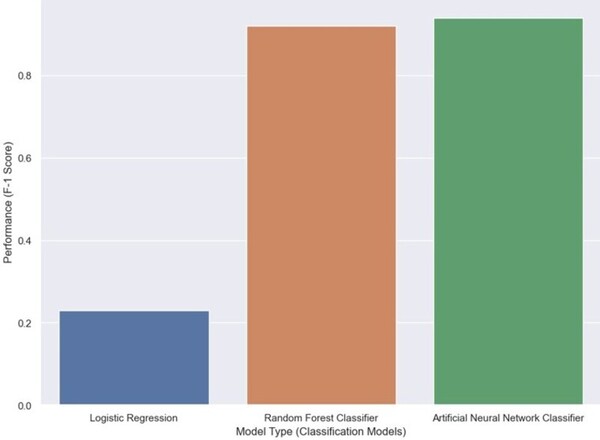

The authors looked at the ability of different machine learning algorithms to predict the level of financial corruption in different countries.

Read More...Predicting and explaining illicit financial flows in developing countries: A machine learning approach

The authors looked at the ability of different machine learning algorithms to predict the level of financial corruption in different countries.

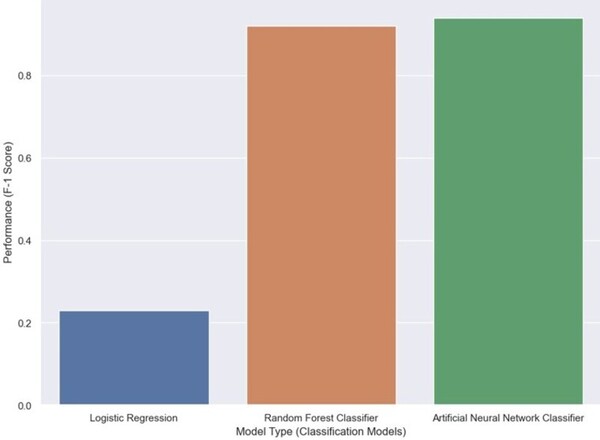

Read More...The effect of financial and food-based incentives on math test performance

The authors looked at the effect of monetary vs. food incentives on math test performance. They found that financial incentives did increase student performance, but not necessarily food incentives.

Read More...Analyzing carbon dividends’ impact on financial security via ML & metaheuristic search

Impact of carbon tax and dividend on financial security

Read More...Comparing and evaluating ChatGPT’s performance giving financial advice with Reddit questions and answers

Here, the authors compared financial advice output by chat-GPT to actual Reddit comments from the "r/Financial Planning" subreddit. By assessing the model's response content, length, and advice they found that while artificial intelligence can deliver information, it failed in its delivery, clarity, and decisiveness.

Read More...Environmental, social, and governance ratings and firm performance: Evidence from the Chinese stock market

Large corporations often are known for their financial power, but what social and environmental power and conscious do they have? The more responsible corporations are in relation to environmental, social, and governance criteria the better they do fiscally.

Read More...The Effects of Vibrotactile Feedback on Task Performance in a 3D-printed Myoelectric Prosthetic Arm

Here the authors strive to remedy the financial and mechanical deficiencies in current prosthetics by building a simple, noninvasive vibratory sensory feedback system into an inexpensive constructed 3D-printed prosthetic arm. They find that this simple feedback system has the potential to enhance feedback performance at a less cost.

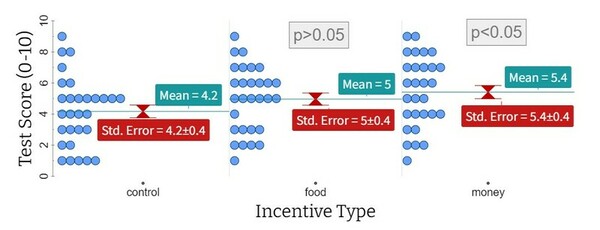

Read More...Assessing grass water use efficiency through smartphone imaging and ImageJ analysis

Overwatering and underwatering grass are widespread issues with environmental and financial consequences. This study developed an accessible method to assess grass water use efficiency (WUE) combining smartphone imaging with open access color unmixing analysis. The method can be applied in automated irrigation systems or apps, providing grass WUE assessment for regular consumer use.

Read More...Money matters: Significant knowledge gaps exist about basic finance

In this study, the authors survey students and adults to better understand their basic financial knowledge and money saving skills to measure the extent of knowledge in each group and make comparisons between.

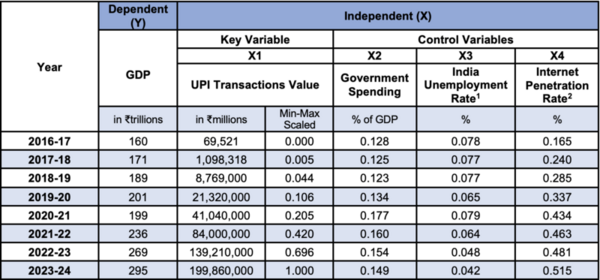

Read More...India’s digital public infrastructure: Analyzing UPI and Aadhaar in GDP growth and cost optimization

India’s Digital Public Infrastructure (DPI)—including the Unified Payments Interface (UPI) and Aadhaar—has been globally recognized for advancing financial inclusion and efficient governance. This study analyzes data from 2016–17 to 2023–24 the impact of these services on India's GDP.

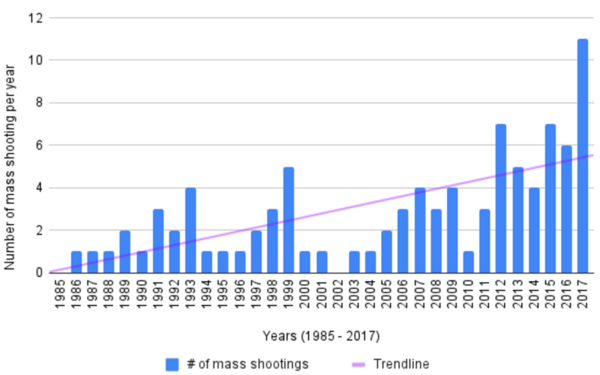

Read More...The effect of economic downturns on the frequency of mass shootings

Researching gun violence and mass shootings in the U.S. is difficult due to the lack of consistent data collection. Some studies have linked mass shootings to personal financial stress, but little formal research exists on the impact of broader economic conditions. This study hypothesized an inverse relationship between mass shootings and economic performance, using the S&P 500 and unemployment rate as indicators.

Read More...