The authors examine a relationship between tweet sentiment and stock market behavior during the early weeks of the COVID-19 pandemic.

Read More...Understanding investors behaviors during the COVID-19 outbreak using Twitter sentiment analysis

The authors examine a relationship between tweet sentiment and stock market behavior during the early weeks of the COVID-19 pandemic.

Read More...Reddit v. Wall Street: Why Redditors beat Wall Street at its own game

Here the authors investigated the motivation of a short squeeze of GameStop stock where users of the internet forum Reddit drove a sudden increase in GameStop stock price during the start of 2021. They relied on both qualitative and quantitative analyses where they tracked activity on the r/WallStreetBets subreddit in relation to mentions of GameStop. With these methods they found that while initially the short squeeze was driven by financial motivations, later on emotional motivations became more important. They suggest that social phenomena can be dynamic and evolve necessitating mixed method approaches to study them.

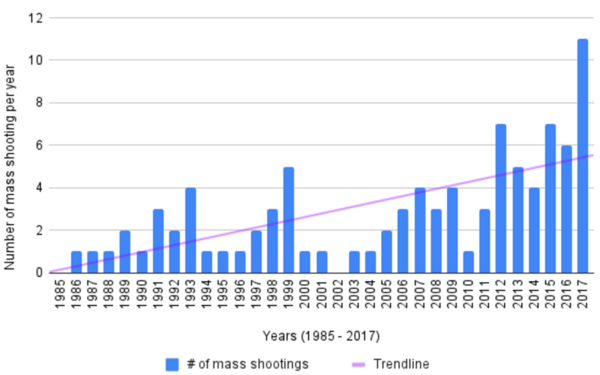

Read More...The effect of economic downturns on the frequency of mass shootings

Researching gun violence and mass shootings in the U.S. is difficult due to the lack of consistent data collection. Some studies have linked mass shootings to personal financial stress, but little formal research exists on the impact of broader economic conditions. This study hypothesized an inverse relationship between mass shootings and economic performance, using the S&P 500 and unemployment rate as indicators.

Read More...The determinants and incentives of corporate greenhouse gas emission reduction

This study used hand-collected Greenhouse gas (GHG) emissions data from the Environmental Protection Agency (EPA) and aimed to understand the determinants and incentives of GHG emissions reduction. It explored how companies’ financials, Chief Executive Officer (CEO) compensation, and corporate governance affected GHG emissions. Results showed that companies reporting GHG emissions were wide-spread among the 48 industries represented by two-digit Standard Industrial Classification (SIC) codes.

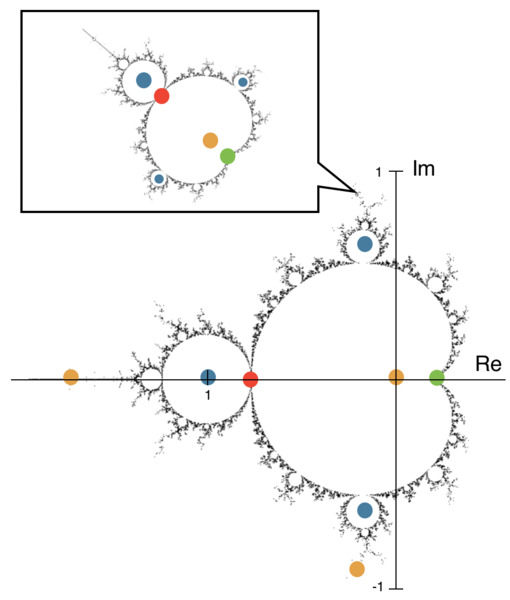

Read More...Discovery of the Heart in Mathematics: Modeling the Chaotic Behaviors of Quantized Periods in the Mandelbrot Set

This study aimed to predict and explain chaotic behavior in the Mandelbrot Set, one of the world’s most popular models of fractals and exhibitors of Chaos Theory. The authors hypothesized that repeatedly iterating the Mandelbrot Set’s characteristic function would give rise to a more intricate layout of the fractal and elliptical models that predict and highlight “hotspots” of chaos through their overlaps. The positive and negative results from this study may provide a new perspective on fractals and their chaotic nature, helping to solve problems involving chaotic phenomena.

Read More...