Predicting and explaining illicit financial flows in developing countries: A machine learning approach

(1) Coppell High School, (2) Agilent Technologies, Inc.

https://doi.org/10.59720/24-030

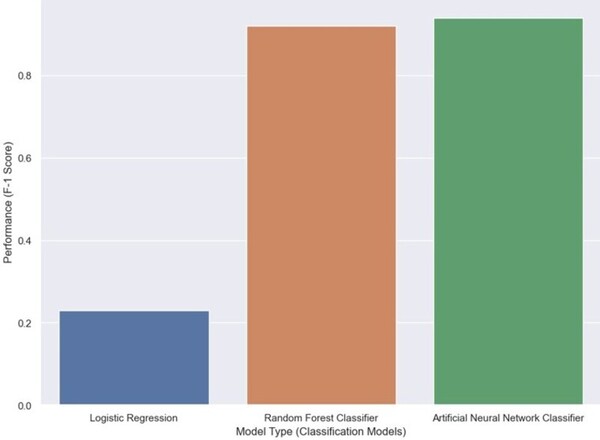

Cross-border corruption and the illicit movement of financial assets, referred to as illicit financial flows (IFFs), have a strongly deleterious effect on the economies of developing nations. Over the past 20 years, there has been a concerted international effort to mitigate cross-border corruption; however, the most important economic and political factors leading to IFFs are unclear. In this work, we used multiple machine learning (ML) approaches—including linear regression, logistic regression, random forests, and neural networks—to predict the levels of corruption using various economic and political measures from the years 2009 to 2018. Furthermore, to make clear the relative importance of these factors, we used several ML model interpretation tools. We hypothesized that the artificial neural network (ANN) machine learning model can most effectively predict and explain IFFs in developing countries using economic and political indicators. Out of the various regression ML models, the ANN had the most success in predicting the IFFs, with a Pearson correlation coefficient of 0.97. The most important features, as quantified using Shapley values from the ANN and the feature importances of the random forest models were: aid percent of gross national income, population, human development indicator income, and government efficiency. Taken together, these models and their interpretation provide a method for predicting the IFFs as well as the features that drive them, enabling policymakers to focus on these factors to decrease corruption.

This article has been tagged with: