.png)

The authors looked at the difference in investing in stock vs. mutual funds.

Read More...Where to invest: Stock market indices versus mutual funds

Environmental, social, and governance ratings and firm performance: Evidence from the Chinese stock market

Large corporations often are known for their financial power, but what social and environmental power and conscious do they have? The more responsible corporations are in relation to environmental, social, and governance criteria the better they do fiscally.

Read More...Quantum-inspired neural networks enhance stock prediction accuracy

The authors developed a quantum inspired model for stock market fluctuations.

Read More...Exploring the effects of diverse historical stock price data on the accuracy of stock price prediction models

Algorithmic trading has been increasingly used by Americans. In this work, we tested whether including the opening, closing, and highest prices in three supervised learning models affected their performance. Indeed, we found that including all three prices decreased the error of the prediction significantly.

Read More...Understanding investors behaviors during the COVID-19 outbreak using Twitter sentiment analysis

The authors examine a relationship between tweet sentiment and stock market behavior during the early weeks of the COVID-19 pandemic.

Read More...Reddit v. Wall Street: Why Redditors beat Wall Street at its own game

Here the authors investigated the motivation of a short squeeze of GameStop stock where users of the internet forum Reddit drove a sudden increase in GameStop stock price during the start of 2021. They relied on both qualitative and quantitative analyses where they tracked activity on the r/WallStreetBets subreddit in relation to mentions of GameStop. With these methods they found that while initially the short squeeze was driven by financial motivations, later on emotional motivations became more important. They suggest that social phenomena can be dynamic and evolve necessitating mixed method approaches to study them.

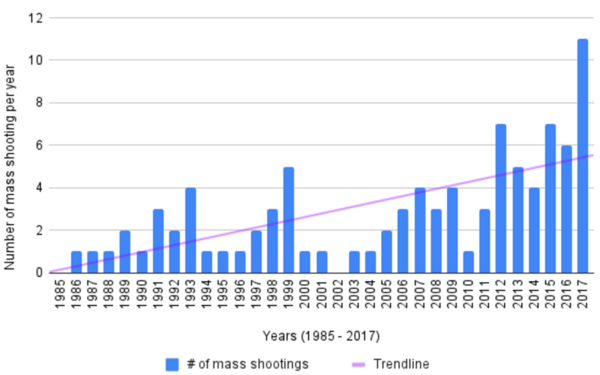

Read More...The effect of economic downturns on the frequency of mass shootings

Researching gun violence and mass shootings in the U.S. is difficult due to the lack of consistent data collection. Some studies have linked mass shootings to personal financial stress, but little formal research exists on the impact of broader economic conditions. This study hypothesized an inverse relationship between mass shootings and economic performance, using the S&P 500 and unemployment rate as indicators.

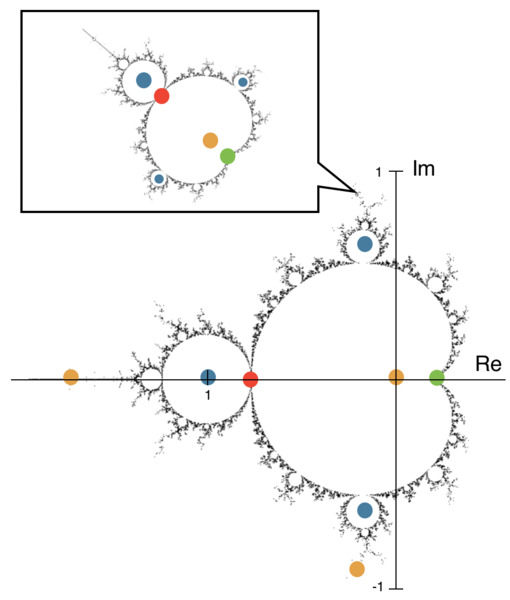

Read More...Discovery of the Heart in Mathematics: Modeling the Chaotic Behaviors of Quantized Periods in the Mandelbrot Set

This study aimed to predict and explain chaotic behavior in the Mandelbrot Set, one of the world’s most popular models of fractals and exhibitors of Chaos Theory. The authors hypothesized that repeatedly iterating the Mandelbrot Set’s characteristic function would give rise to a more intricate layout of the fractal and elliptical models that predict and highlight “hotspots” of chaos through their overlaps. The positive and negative results from this study may provide a new perspective on fractals and their chaotic nature, helping to solve problems involving chaotic phenomena.

Read More...Constructing an equally weighted stock portfolio based on systematic risk (beta)

In this article, the authors investigate whether stock selection across various sectors is efficient enough to outperform an overall market. Stocks from 2006 to 2020 were selected across sectors to calculate beta values using the Capital Asset Pricing Model.

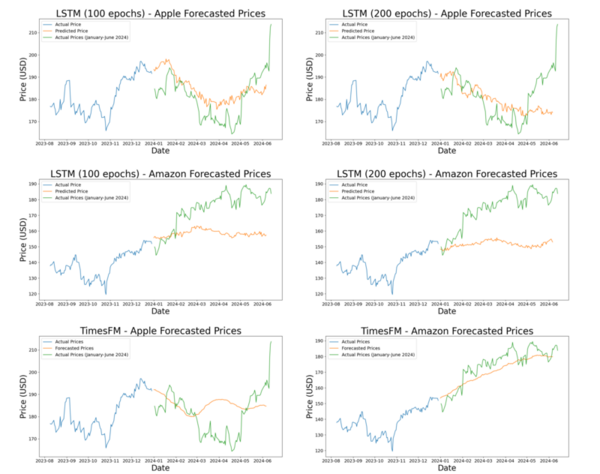

Read More...Stock price prediction: Long short-term memory vs. Autoformer and time series foundation model

The authors looked the ability to predict future stock prices using various machine learning models.

Read More...