The authors looked at how students performed on standardized tests when they were taught material via memorization vs. conceptual based approaches.

Read More...The impact of conceptual versus memorization-based teaching methods on student performance

The authors looked at how students performed on standardized tests when they were taught material via memorization vs. conceptual based approaches.

Read More...Analyzing carbon dividends’ impact on financial security via ML & metaheuristic search

Impact of carbon tax and dividend on financial security

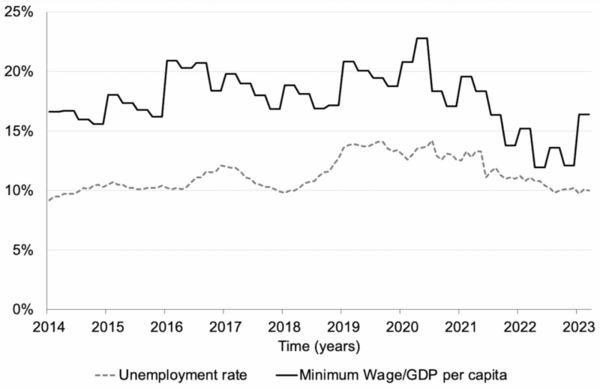

Read More...Determining the relationship between unemployment and minimum wage in Turkey

The authors looked at the relationship between unemployment and minimum wage in Turkey (Türkiye). They found that there is a positive correlation between minimum wage and unemployment.

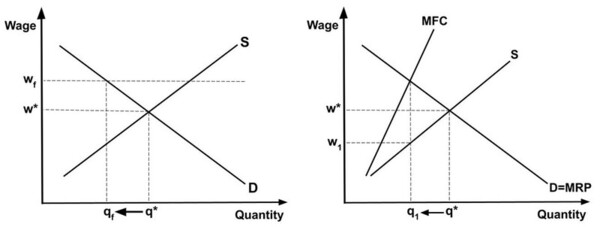

Read More...Long-run effects of minimum wage on labor market dynamics

The authors looked at potential downstream effects of raising the minimum wage. Specifically they focused on taxable wages, employment, and firm counts.

Read More...Exploring the effects of diverse historical stock price data on the accuracy of stock price prediction models

Algorithmic trading has been increasingly used by Americans. In this work, we tested whether including the opening, closing, and highest prices in three supervised learning models affected their performance. Indeed, we found that including all three prices decreased the error of the prediction significantly.

Read More...Using economic indicators to create an empirical model of inflation

Here, seeking to understand the correlation of 50 of the most important economic indicators with inflation, the authors used a rolling linear regression to identify indicators with the most significant correlation with the Month over Month Consumer Price Index Seasonally Adjusted (CPI). Ultimately the concluded that the average gasoline price, U.S. import price index, and 5-year market expected inflation had the most significant correlation with the CPI.

Read More...Are Teens Willing to Pay More for Their Preferred Goods?

Each day we are flooded with new items that promise us a better experience at a better price. This forces buyers to continuously chose between sticking to what they know, or trying something new. In turn, companies need to be aware of the factors affecting consumer choices, that too within the different fractions of society. In this study the authors investigate the effect of survey-based price setting on profits made based on African American teen purchases, and how African-American teen loyalty to a particular brand affects their willingness to pay a higher price than the market average for their preferred brand items.

Read More...The effect of default opt-ins and social proof tags on high-stake decision-making in an e-commerce context

Default opt-ins and social proof tags effect on decision making in an e-commerce context

Read More...The Mount Laurel doctrine: A case study in housing affordability and the labor market in New Jersey

The authors explored the effects of the Mount Laurel Doctrine on housing affordability, unemployment rate, and civilian labor force in Burlington County, New Jersey compared to nearby counties.

Read More...Money matters: Significant knowledge gaps exist about basic finance

In this study, the authors survey students and adults to better understand their basic financial knowledge and money saving skills to measure the extent of knowledge in each group and make comparisons between.

Read More...