.png)

The authors looked at the difference in investing in stock vs. mutual funds.

Read More...Where to invest: Stock market indices versus mutual funds

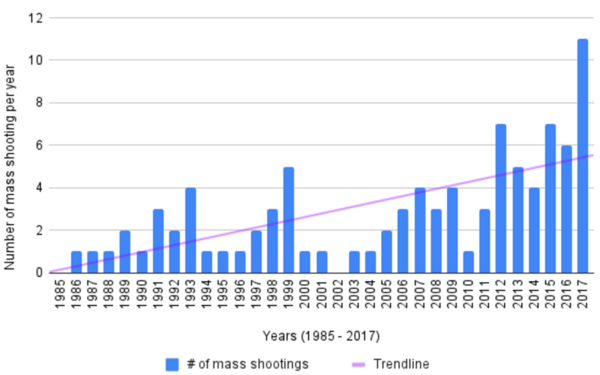

The effect of economic downturns on the frequency of mass shootings

Researching gun violence and mass shootings in the U.S. is difficult due to the lack of consistent data collection. Some studies have linked mass shootings to personal financial stress, but little formal research exists on the impact of broader economic conditions. This study hypothesized an inverse relationship between mass shootings and economic performance, using the S&P 500 and unemployment rate as indicators.

Read More...Environmental, social, and governance ratings and firm performance: Evidence from the Chinese stock market

Large corporations often are known for their financial power, but what social and environmental power and conscious do they have? The more responsible corporations are in relation to environmental, social, and governance criteria the better they do fiscally.

Read More...The Role of Corresponding Race, Gender, and Species as Incentives for Charitable Giving

Inherent bias is often the unconscious driver of human behavior, and the first step towards overcoming these biases is our awareness of them. In this article the authors investigate whether race, gender or species affect the choice of charity by middle class Spaniards. Their conclusions serve as a starting point for further studies that could help charities refine their campaigns in light of these biases effectively transcending them or taking advantage of them to improve their fundraising attempts.

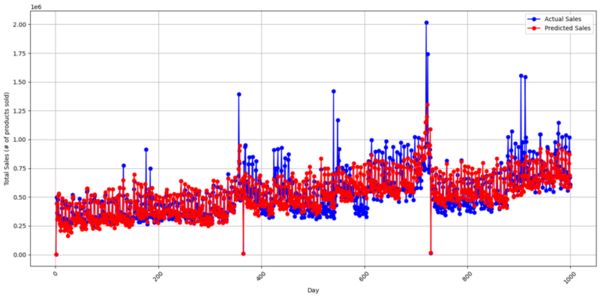

Read More...Analyzing market dynamics and optimizing sales performance with machine learning

This study uses interpretable machine learning models, lasso and ridge regression with Shapley analysis, to identify key sales drivers for Corporación Favorita, Ecuador’s largest grocery chain. The results show that macroeconomic factors, especially labor force size, have the greatest impact on sales, though geographic and seasonal variables like city altitude and holiday proximity also play important roles. These insights can help businesses focus on the most influential market conditions to enhance competitiveness and profitability.

Read More...Understanding investors behaviors during the COVID-19 outbreak using Twitter sentiment analysis

The authors examine a relationship between tweet sentiment and stock market behavior during the early weeks of the COVID-19 pandemic.

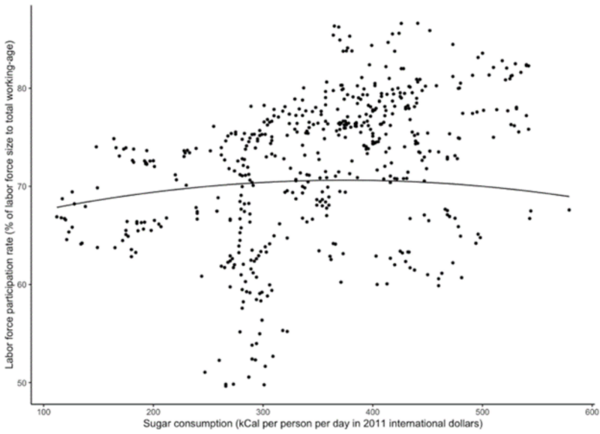

Read More...A spatiotemporal analysis of OECD member countries on sugar consumption and labor force participation

In this article the authors look at sugar consumption and the relationship to productivity in the work/labor force.

Read More...Reddit v. Wall Street: Why Redditors beat Wall Street at its own game

Here the authors investigated the motivation of a short squeeze of GameStop stock where users of the internet forum Reddit drove a sudden increase in GameStop stock price during the start of 2021. They relied on both qualitative and quantitative analyses where they tracked activity on the r/WallStreetBets subreddit in relation to mentions of GameStop. With these methods they found that while initially the short squeeze was driven by financial motivations, later on emotional motivations became more important. They suggest that social phenomena can be dynamic and evolve necessitating mixed method approaches to study them.

Read More...Detection and Control of Spoilage Fungi in Refrigerated Vegetables and Fruits

Food spoilage leads to a significant loss in agricultural produce each year. Here, the authors investigate whether certain essential oils can protect against fungus-mediated spoilage of fruits and vegetables. Their results suggest that the compounds they tested might indeed inhibit fungal growth, at various temperatures, a promising result that could reduce food wasting.

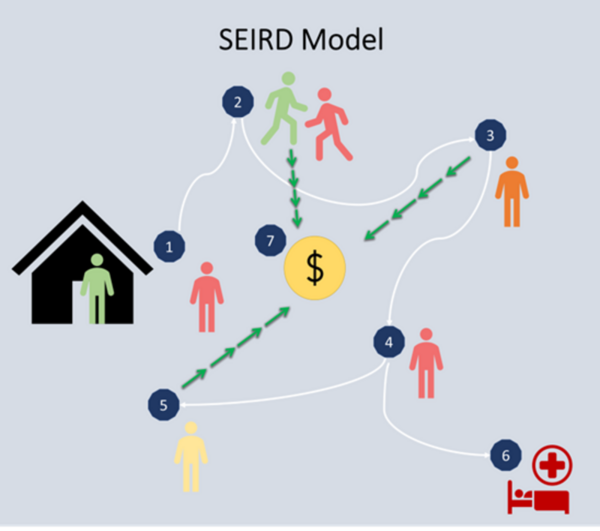

Read More...Modeling and optimization of epidemiological control policies through reinforcement learning

Pandemics involve the high transmission of a disease that impacts global and local health and economic patterns. Epidemiological models help propose pandemic control strategies based on non-pharmaceutical interventions such as social distancing, curfews, and lockdowns, reducing the economic impact of these restrictions. In this research, we utilized an epidemiological Susceptible, Exposed, Infected, Recovered, Deceased (SEIRD) model – a compartmental model for virtually simulating a pandemic day by day.

Read More...